The Difference Between BlueSelect, BlueCare, and BlueOptions

By Mark Bailey, Jr.

Updated November 8, 2016

Originally published December 4, 2015

This post was originally published in December 2015 and has been completely revamped and updated for accuracy and comprehensiveness.

Buying a health insurance policy on your own can be tricky. There’s a lot of pressure to choose the right plan, especially since you’ll be stuck with it until the next Open Enrollment period in late 2017.

One of the most important factors to pay attention to when selecting a health insurance plan is the plan’s network. Florida Blue offers plans that fall into three networks: BlueSelect, BlueCare, and Blue Options.

At first glance, it can be difficult to decipher the difference between these networks. Why would one choose BlueSelect over BlueOptions or BlueCare? Is one network better than the rest?

Well, I did some serious digging and asking around and here’s what I found out about Florida Blue’s three core plan options.

They’re Just Nicknames for Networks

BlueSelect, BlueCare, and BlueOptions are essentially nicknames for the type of networks you’ll be joining. Here are the network breakdowns for each plan:

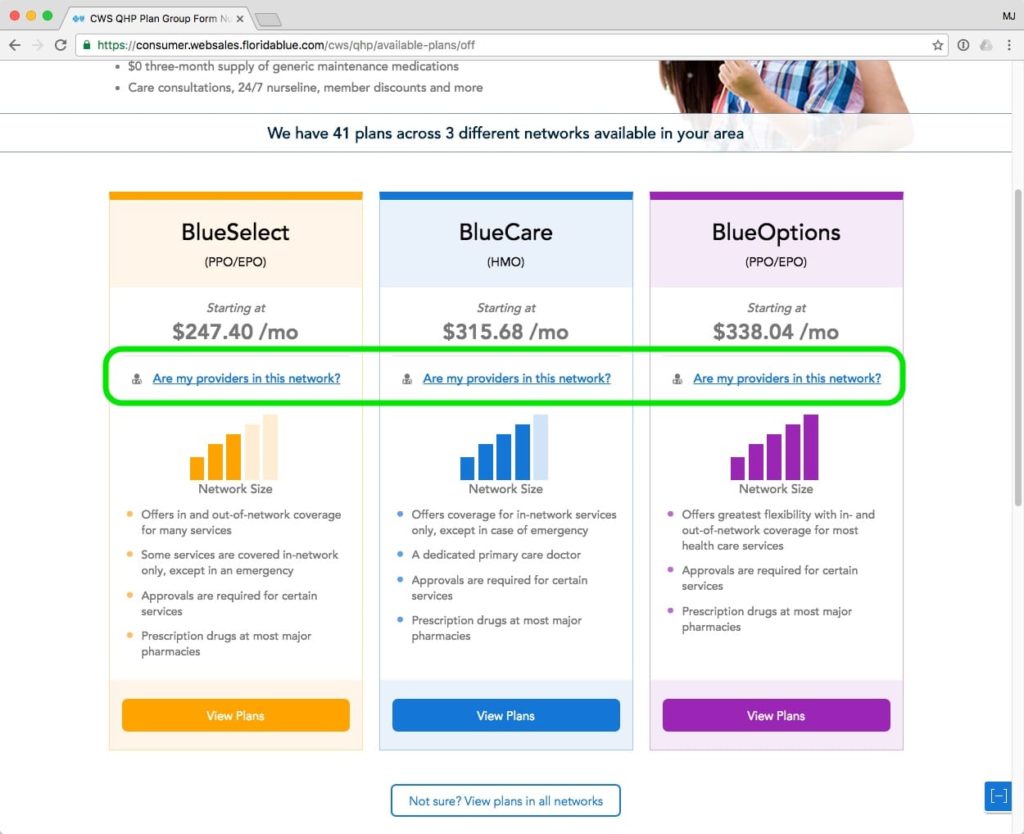

- BlueOptions PPO/EPO (Preferred Provider Organization / Exclusive Provider Organization) is Florida Blue’s largest network with over 30,000 doctors. According to Florida Blue, BlueOptions offers the greatest flexibility with in- and out-of-network coverage for most health care services. You can generally expect to pay a larger monthly premium to access this network.

- BlueCare HMO (Health Maintenance Organization) is Florida Blue’s middle tier network. It has over 29,000 doctors, 231 hospitals and most major pharmacy chains. BlueCare offers no coverage for out-of-network services outside of Florida, except in an emergency.

- BlueSelect PPO/EPO is Florida Blue’s smallest network with over 16,000 doctors, 100 hospitals and most major pharmacy chains. Out-of-network coverage in or outside of Florida for many services. The plans you’ll find in this network are generally the cheapest.

Essentially, all you need to know about a network is that it’s a group of physicians, hospitals, and other health care providers that has agreed to lower negotiated charges through Florida Blue. That means typically you’ll end up paying less money when you visit providers within your plan’s network.

This would probably be a good time to bring up the fact that CVS is dropping out of Florida Blue’s pharmacy network for ACA plans in 2017. If you use CVS, Target, or Navarro pharmacies and you have an ACA compliant plan, it’s time to start looking at other options.

Now that we’ve figured all that out, we’re going to move on to the next important step which is find out if the doctors, specialists, and hospitals you use are in any of those networks.

Is My Doctor, Specialist, or Hospital In-Network?

Checking to see if your doctor, specialist, or hospital is in-network is a critical step that many don’t think to take before picking out a new health plan.

Luckily, Florida Blue has made this incredibly easy to do this year.

Here’s a step-by-step guide of how to check if your providers are in-network with BlueSelect, BlueCare, and BlueOptions.

If you prefer watching something over reading, I created a short walkthrough video that goes through the entire process outlined below.

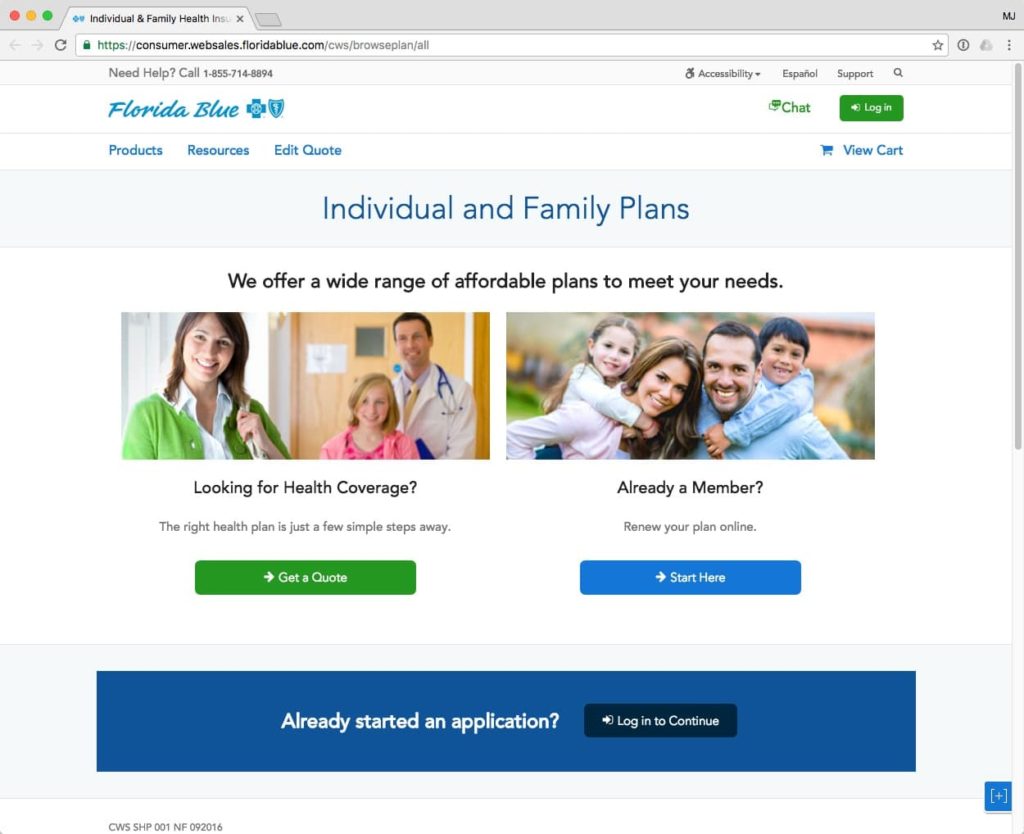

Starting on the Individual & Family Plans quote page on Florida Blue’s website, you’ll want to select Get a Quote.

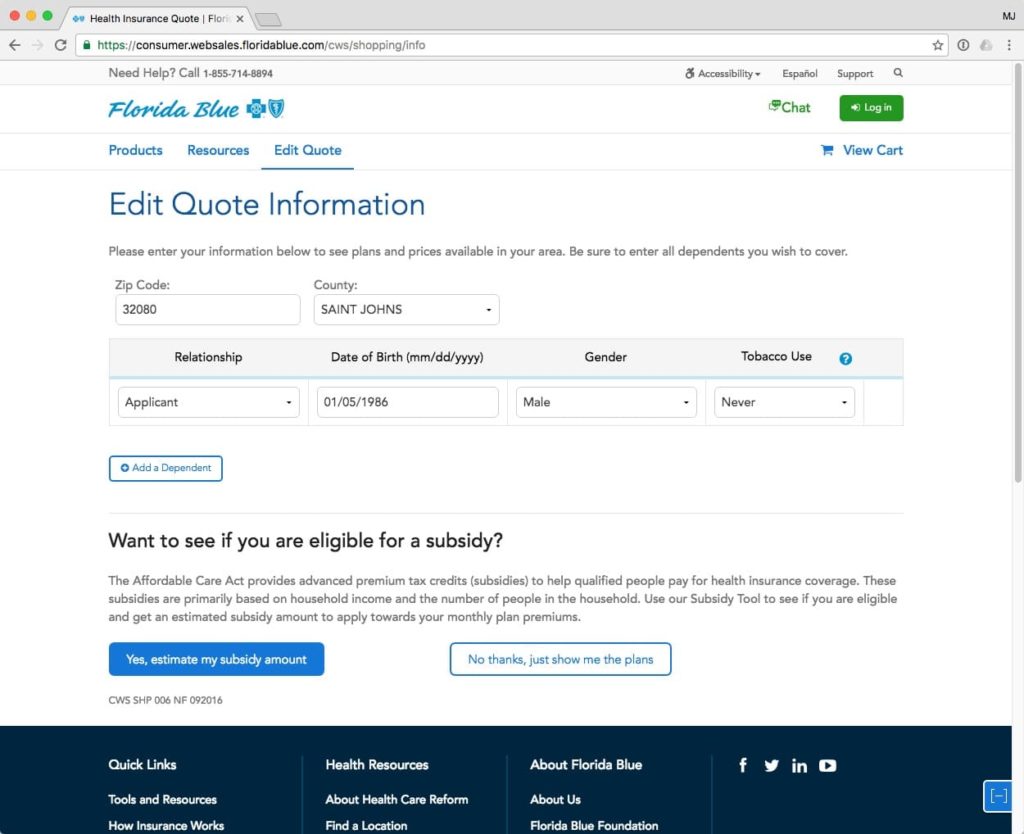

Next, you’ll need to enter some basic information about the individuals that will be covered under your plan.

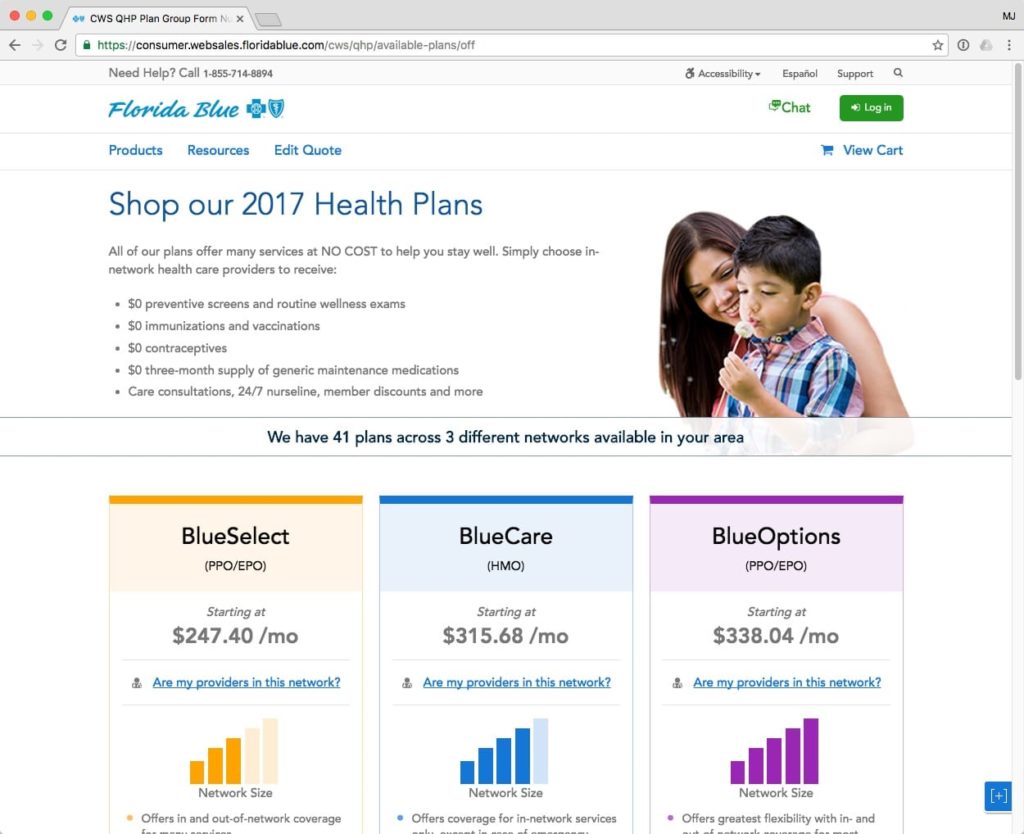

You should now see this screen which shows you the available plans and networks in your area. This is exactly where we want to be.

Before you do anything else, make sure you click the link in the colored boxes under each network name that says Are my providers in this network? Don’t worry about which link you click as they will all take you to the same place.

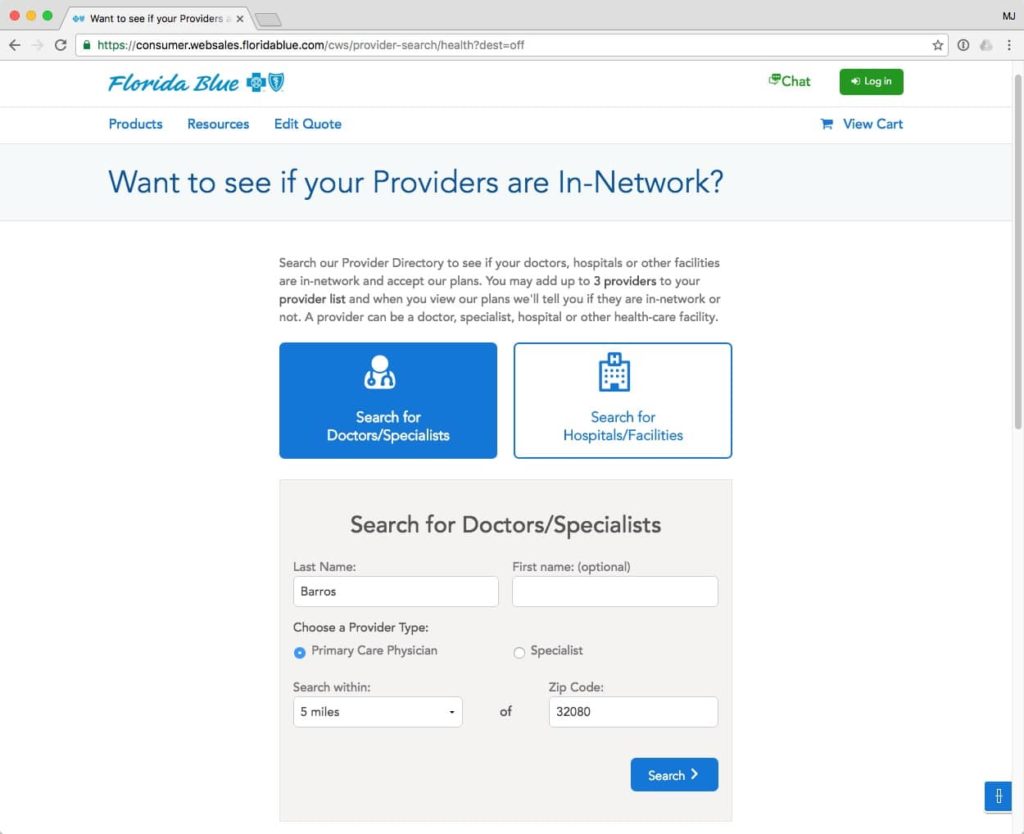

Here, you’ll want to enter the main doctors, specialists, and hospitals you utilize. I’m going to start by adding my Primary Care Physician (PCP). Remember that you can only add three providers to your list, so only choose the providers you rely on the most.

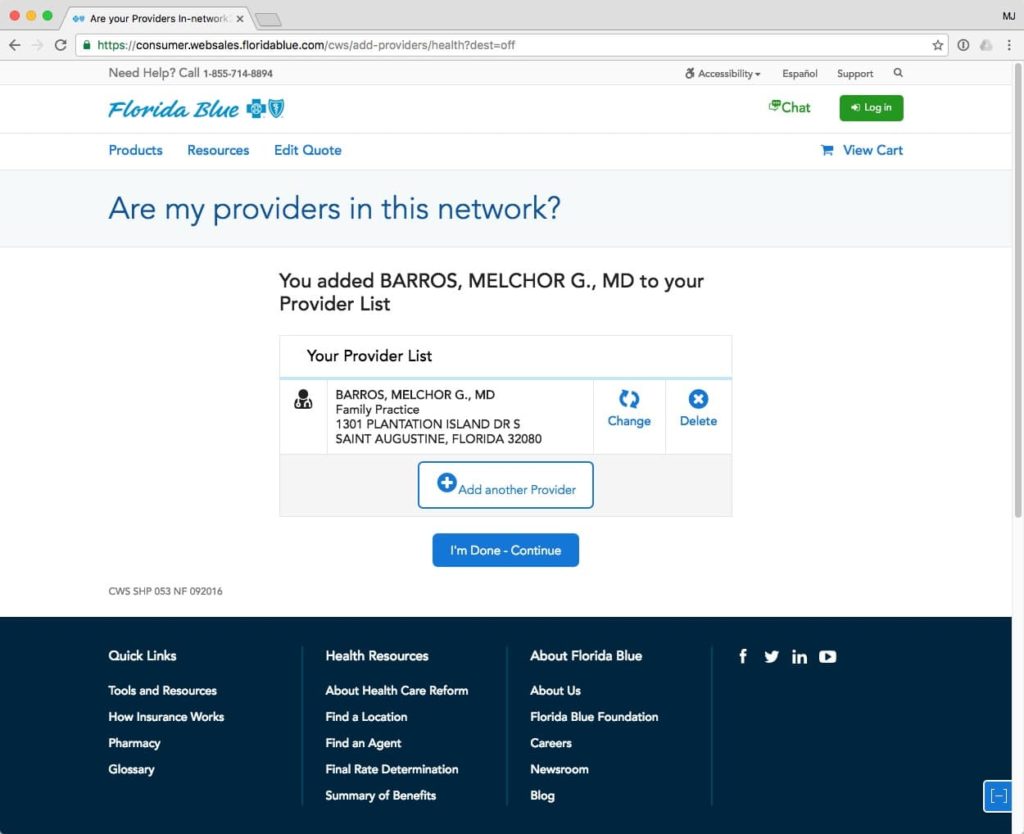

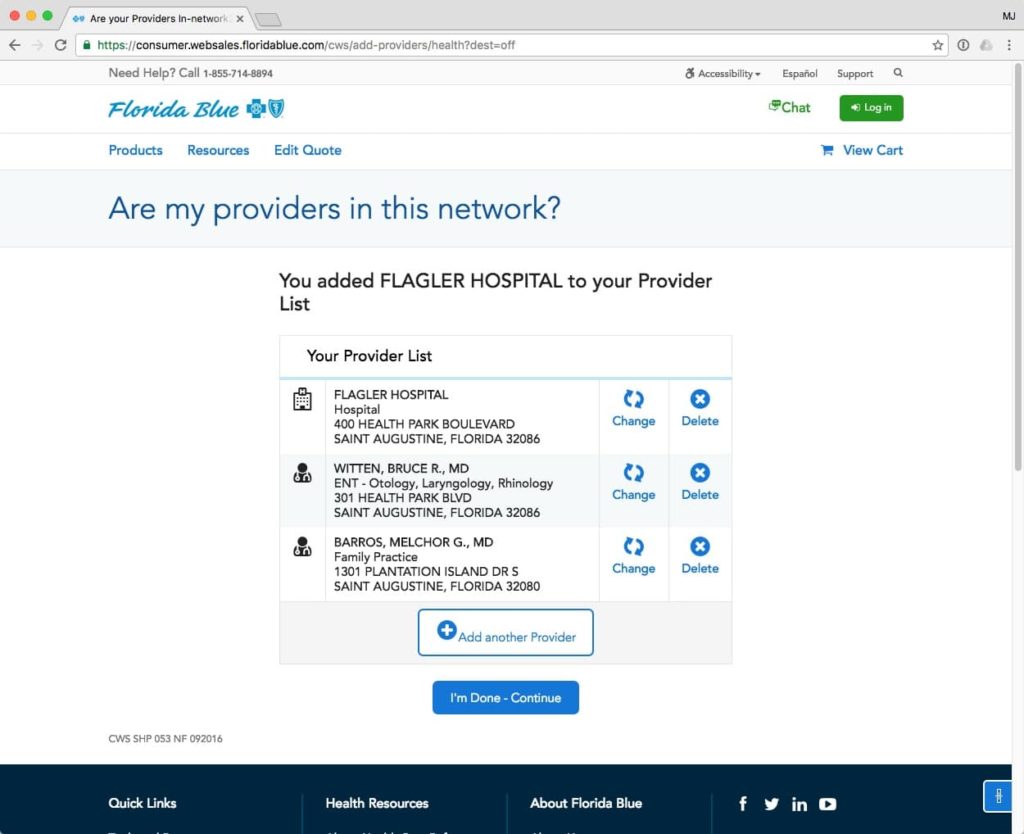

Now that I’ve added my PCP to my list, I’m going to add the specialist and hospital I use the most by clicking Add another Provider.

Great! I’ve got my provider list narrowed down. Time to click I’m Done – Continue.

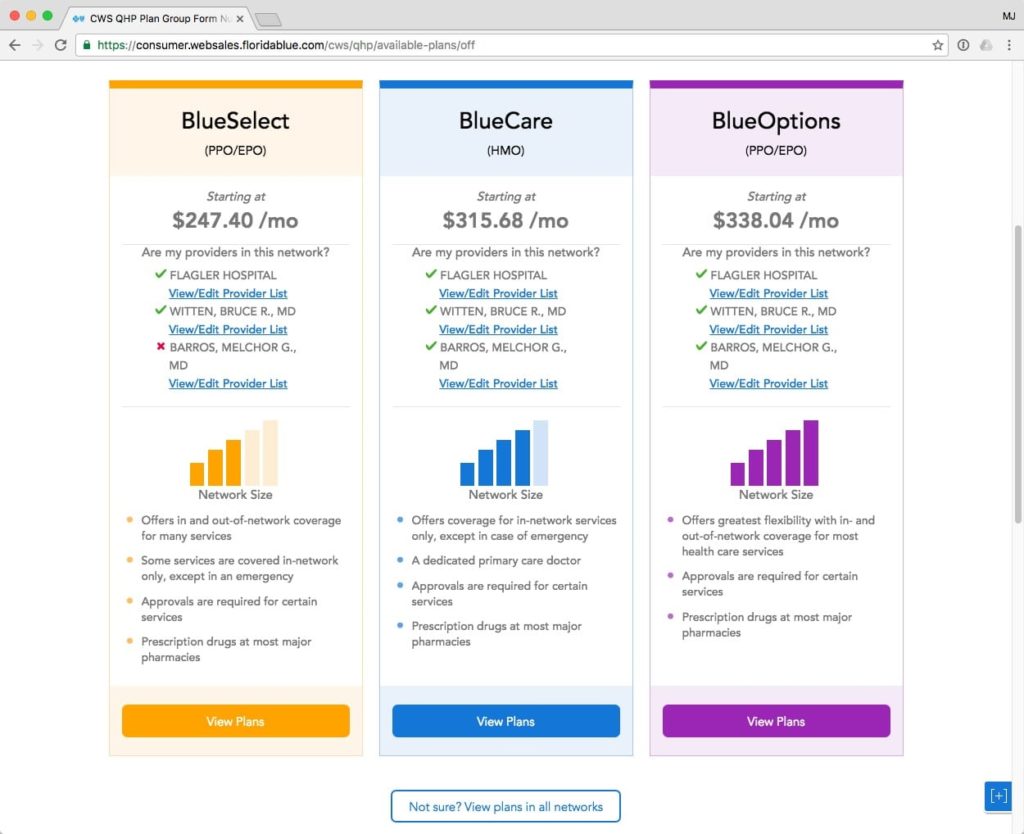

This is where the magic happens. Because I have taken the time to add my providers to my list, I can now see which of my providers are in-network with BlueSelect, BlueCare, and BlueOptions.

This simple step has already made my network choice easier as I now know I wouldn’t want to choose BlueSelect since my Primary Care Physician isn’t in-network.

You will still have to try to figure out the exact plan that will fit your needs based things like deductibles, out-of-pocket maximums, and co-pays, but at least you’ve narrowed things down a bit.

If you’re in Florida and you’re in the market for a Florida Blue plan, we can help you narrow down your choices and get you enrolled – at no additional cost. Simply click Start a Quote to get started.

Mark Bailey, Jr. is the Senior Marketing Manager of NFP's Atlantic region. Before joining the company, Mark was a production assistant on the tv show Glee and an on-air talent on 95.1 WAPE. He has over 10 years of experience in the insurance and corporate benefits space. Mark is an avid Jacksonville Jaguars fan and loves to spend his free time building custom mechanical keyboards.