The ABC and Ds of Medicare

By Hannah Ferris

Published February 5, 2014

Medicare is a federal health insurance program for people aged 65 or older. It is a multifaceted program that offers health services ranging from hospital care to prescription drug coverage. Senior citizens may subscribe to some or all “Parts” of the Medicare program, based on their individual needs or preferences.

This guide will introduce you to the basics, the “ABCs”, quite literally, of Medicare. Medicare has four parts – Parts A and B, known as Original Medicare, provides basic coverage, and Parts C and D provide add-on services, as Original Medicare does not cover all medical expenses or the cost of most long-term care.

Each part of Medicare plays a critical role in the health care an individual will receive once they are enrolled.

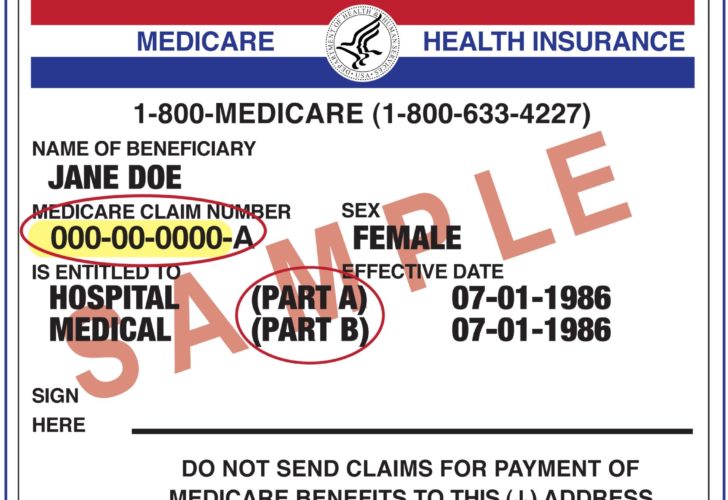

Original Medicare: Parts A and B

Part A is hospital insurance. Part A helps pay for inpatient care in a hospital or a skilled nursing facility (i.e. a stay in a rehabilitation center after joint replacement surgery) and may cover some home health care and hospice care. According to Medicare.gov, Medicare Part A covers services and supplies deemed medically necessary to treat a condition. Part A benefits are largely funded by the payroll tax, and thus, most Medicare patients do not pay a monthly premium for Part A hospital insurance.

Part B is medical insurance. Part B helps pay for doctors’ services and other medical services and supplies not covered by Part A. Anyone who is eligible for Part A is also eligible for Part B. However, enrolling in Part B involves paying a monthly premium for coverage. Two types of coverage – medically necessary and preventive services – are included in Part B. Such services could include ambulance transportation, access to mental health specialists, and the ability to visit a new doctor for a second opinion before surgery.

It is important to note that Parts A and B do not include provisions for long-term care, or assisted living. Supplemental private health plans (Medigap plans) or Medicare Health Plans may cover long-term care and have many advantages, especially for the elderly.

Optional Medicare Health Plans: Parts C and D

Medicare Advantage, or Part C, is a set of Medicare-sponsored insurance plans that organize both Part A and Part B benefits. To enroll in a Medicare Advantage plan, an individual must be previously enrolled in both Parts A and B of Medicare. These plans are offered by private companies that contract with Medicare and may take the form of health maintenance organizations (HMOs) or preferred provider organizations (PPOs). Medicare Advantage programs generally cover many of the same benefits that a Medigap policy would cover and, like a Medigap policy, a monthly premium, determined by the private company, is paid for the extra benefits.

Prescription Drug Coverage, Part D, is a program that helps pay for medications that doctors prescribe. Enrolling in Part D is also voluntary and requires the payment of an additional monthly premium. The monthly costs vary and depend largely upon the prescriptions that an individual’s health maintenance demands. Part D plans are generally subject to coverage gaps, or temporary limits on what the drug plan will cover. In 2014, as per ACA standards, once an individual’s plan is subject to the coverage gap – he will pay 47.5% of the plan’s cost for brand-name drugs and 72% for generic drugs until the coverage gap ends (or a certain amount has been spent out-of-pocket). This aspect of Medicare Part D has been controversial. However, Part D plans are highly flexible and unlike Medicare Advantage, Part D coverage may be used in addition to other Medicare or Medigap plans.

The First Step

Understanding the benefits of Parts A-D of the Medicare program is only the first step in obtaining the best possible Medicare and/or supplemental insurance coverage for you. Be sure to check back for the next installation of the Bailey Group’s guide to Medicare – How to Apply for Medicare – coming soon!

Hannah Ferris was a past intern at the Bailey Group. Her interests in social policy and public health yield unique insights into health care reform. Ferris entered the MSc Social Policy and Development program at the London School of Economics in 2014. She loves traveling, fashion, and writing her own personal blog, "Hannah's Happenings."